First-Time Homebuyers Are Older Than Ever in 2025 — Here’s What That Means in Omaha

If it feels like first-time homebuyers are older than they used to be — you’re right.

According to the 2025 Profile of Home Buyers and Sellers from the National Association of REALTORS®, the median age of first-time homebuyers hit 40 this year, the highest ever recorded.

That’s up from 38 last year — and a huge jump from the late 20s back in the 1980s. So what’s behind the delay, and how does it affect buyers here in the Omaha metro?

Let’s dig in.

It’s Not Just You — Buying a Home Really Is Harder Now

The same report shows first-time buyers make up only 21% of all home purchases, the lowest share ever tracked. Historically, it’s been closer to 40%.

That means fewer people are managing to buy their first home, and those who do are often waiting longer, saving more, and juggling bigger financial hurdles than buyers from previous generations.

The Growing Divide in Today’s Housing Market

While first-time buyers are shrinking as a group, repeat buyers dominate the market. They’re older, have more equity, and often don’t need financing at all.

-

The median age of repeat buyers is now 62 — another record high.

-

Nearly 30% paid in cash, compared to just 8% of first-time buyers.

-

Repeat buyers’ median down payment: 23%. First-timers: 10% (the highest since 1989).

That level of cash and equity gives repeat buyers a serious edge — especially in competitive markets like Omaha, where homes still sell for roughly 99% of list price on average.

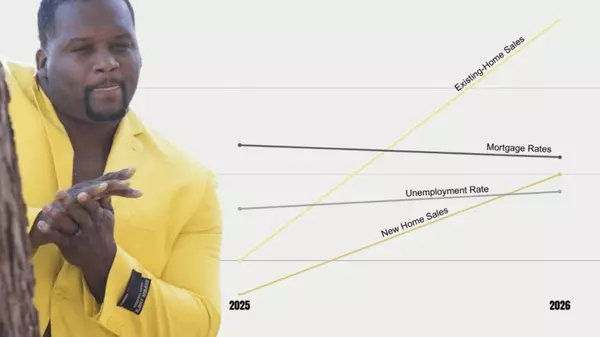

Why It’s So Hard to Break In

Affordability remains the biggest challenge. A few key factors are making it tougher for first-timers to get in the door:

-

Higher mortgage rates. The average during the study period was 6.69%, keeping monthly payments much higher than during the pandemic.

-

Limited affordable inventory. Many new listings in Omaha are priced above the starter-home range, particularly west of 156th Street.

-

Student loans and rent. Among first-time buyers who managed to purchase, 59% used personal savings and 26% drew from retirement accounts or investments — proof that saving while renting is no small feat.

Put all of this together, and it makes sense why the typical first-time buyer in 2025 is 40. It simply takes longer to reach the point of financial readiness.

The Advantage for Repeat Buyers

Repeat buyers have spent the last decade building equity. Most owned their homes for around 11 years before selling, giving them a financial boost to buy their next place with cash or a smaller mortgage.

They’re also more experienced with the process — quicker to act and better positioned to win in multiple-offer situations.

What You Can Do If You’re Buying Your First Home in Omaha

If you’re a first-timer feeling discouraged, don’t. There are still smart ways to compete — and a lot of local programs designed to help.

Here’s where to start:

-

💰 Explore down payment assistance. Nebraska and Iowa both offer grants and forgivable loans for first-time buyers.

-

🏦 Ask about creative financing. Lenders are using 2-1 buydowns, temporary rate reductions, and closing-cost incentives to make ownership more attainable.

-

🏗️ Look into new construction. Builders in Gretna, Papillion, and Bennington are often offering rate buydowns or price incentives for quick-move-in homes.

-

🏡 Consider multi-generational living. 14% of buyers in 2025 purchased multi-gen homes, often to combine resources or care for family.

-

🤝 Work with a local expert. 88% of buyers used an agent in 2025 — and most said the top reason was to find the right home and negotiate terms. A good agent can also connect you with trusted lenders and local assistance programs.

The Bottom Line

Homeownership looks different in 2025, but it’s still possible — even for first-time buyers.

Yes, the average buyer is older, but also more prepared, more strategic, and more financially stable.

If you’re thinking about buying in the next year or two, start planning now. I can help you run the numbers, explore local programs, and create a clear path from “someday” to “sold.”

👉 Take the Omaha Neighborhood Quiz

👉 Download the Relocation Guide

👉 Book a Call

Recent Posts