Ryan Serhant Says It’s “Nobody’s Market.” Here’s What That Means in Omaha

Buying a home in Omaha right now feels a bit like watching the snow come in over the river: everyone’s trying to guess what’s coming next. Rates are still higher than buyers hoped for, prices haven’t taken any major dips, and national headlines zigzag every week.

Even so, local activity is climbing as rates settle into the low 6s. The question is how to move forward confidently in a market that doesn’t seem to belong to buyers or sellers.

Ryan Serhant, star of Netflix’s Owning Manhattan, recently unpacked the current housing climate on FOX Business and summed it up clearly:

“This isn’t a buyer’s market or a seller’s market. It’s nobody’s market because no one knows what to do.”

Here’s what that means for Omaha and Council Bluffs buyers.

Omaha Market Quick Stats

Latest 2025 local numbers:

-

Median closed price: $340,000

-

Active listings: 2,675

-

Average days on market: 26

These give a snapshot of where Omaha stands: more inventory than last year, prices holding steady, and homes moving at a pace that rewards prepared buyers.

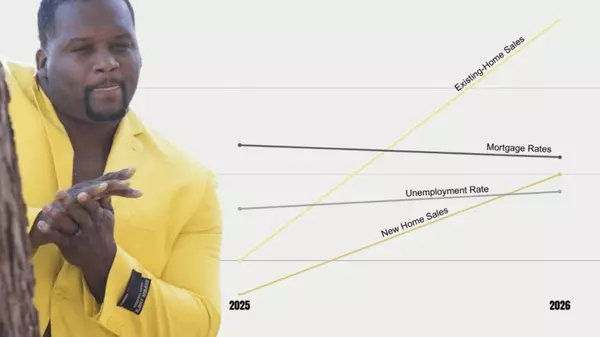

What You Should Know About Mortgage Rates

The big sticking point for most Omaha buyers is affordability. Rates have eased from their peak but aren’t dropping back to pandemic levels. According to Realtor.com’s latest outlook, rates are expected to hover near the low 6s for quite a while. No big dips on the horizon.

Serhant put it bluntly:

“New normal is not low rates. I think people are confused that we’re entering a new normal where we’re going to have lower rates. It’s not going to happen.”

In other words, waiting out the market may keep you renting longer, not winning.

Getting Creative Can Help You Win

Serhant also emphasized how buyers are using creative financing to their advantage.

He shared a recent example:

“I was talking to a client who would never do an adjustable rate mortgage, who now is because they can get it at just over 5%. And they’re probably not going to be in the house for 5 years anyway.”

This is exactly what we’re seeing in Omaha right now. The buyers making moves in Millard, Elkhorn, Papillion, and Benson aren’t necessarily paying less; they’re structuring the deal smarter.

Tools Omaha buyers are using:

-

Adjustable-rate mortgages that match how long you plan to stay

-

Temporary rate buydowns to lower early payments

-

Seller credits to reduce upfront costs

-

Widening searches to neighborhoods with overlooked value

Talk to a lander about different financing options

Finding the Right Home in Omaha

For a lot of renters across Omaha, the bigger risk is waiting for perfect. Rent keeps rising, and every month of waiting is another month not building equity.

Serhant’s take:

“If you’re paying a lot in rent and you’re looking to build equity and you want to buy, now’s as good a time as any.”

Omaha rewards buyers who use strategy instead of hesitation. With the right plan, this “nobody’s market” quickly becomes your market.

If you’re ready to test the waters:

-

Take my Omaha Neighborhood Quiz to find your best-fit area

-

Grab the Omaha Relocation Guide for a full overview

-

Search Omaha homes on my website

-

Book a quick call to go over your budget and goals

Recent Posts