Rent vs. Buy in Omaha in 2025: 4 Real-Life Examples That Might Surprise You

If you're relocating to Omaha and unsure whether to rent first or jump into buying a home, you're not alone. Many families face this exact decision when moving from out of state. In this post, we’ll break down what renting actually costs in Omaha, explore four real-life scenarios, and help you figure out which move makes the most financial sense—especially in a market where home prices continue to rise.

📺 Watch the full video here

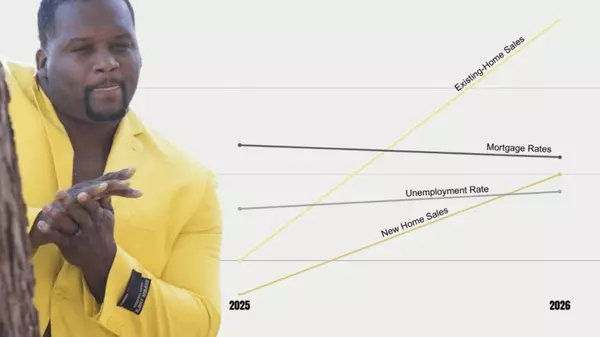

📈 Omaha Home Price Trends: What You Need to Know

Over the last several years, Omaha home values have steadily increased, averaging 3–6% appreciation annually. Even during the 2008 housing crash, Omaha saw far less volatility than many other metros.

Translation? Waiting too long to buy could cost you thousands.

For a broader view of affordability, you can compare Omaha’s cost of living to other major metros.

💰 Rent is No Bargain Either

With limited inventory and a tight rental market, renting in Omaha isn’t the low-cost fallback it once was. Especially if you’re bringing a pet or need more space, many renters are surprised to learn that monthly payments are often comparable—or higher—than a mortgage.

🏠 Pros & Cons of Renting vs Buying in Omaha

Pros of Renting:

-

Flexibility to explore neighborhoods

-

Lower upfront costs

-

Less responsibility for maintenance

-

Quicker move-in timeline

Cons of Renting:

-

No equity or long-term return

-

Pet rent & restrictions

-

Limited inventory

-

Risk of paying high rent for low value

-

Potential for double moves (rent → buy)

Pros of Buying:

-

Build equity from day one

-

Stable payments

-

More inventory and choice

-

Tax benefits

-

More freedom (especially for pet owners)

Cons of Buying:

-

Higher upfront costs (down payment, closing)

-

Maintenance responsibility

-

Requires more planning/timing

-

Commitment anxiety if you’re new to Omaha

📊 4 Real-Life Omaha Examples: Rent vs Buy Breakdown

-

Elkhorn:

Rent = $2,100/month | Buy = $2,279/month

→ Save $6K–$12K in Year 1 by buying -

Papillion:

Rent = $3,400/month | Buy = $4,850/month (10% down)

→ Break even in Year 1, ahead if you stay longer -

Aksarben:

Rent = $2,300/month | Buy = $2,320/month

→ Save $9K–$15K depending on down payment -

Bennington:

Rent = $3,800/month | Buy = $3,500/month

→ Save $15K–$24K just in the first year

🧭 Not Sure Where You Should Live in Omaha?

Take my Neighborhood Match Quiz to discover which part of the metro fits your lifestyle, budget, and commute needs.

Want help comparing school districts? Check out Omaha's best-rated districts on Niche.

📦 Get Your Free Omaha Relocation Guide

Need help navigating schools, local favorites, and hidden gems? Download my Free Relocation Guide packed with everything you need to know before moving.

🚍 Exploring Without a Car?

Omaha has public transit too. Explore routes and service options through Omaha Metro Transit, especially if you're relocating without a vehicle or want to live near a bus line.

🏙️ Want More Local Insight?

The Omaha Chamber of Commerce offers great lifestyle and relocation resources to help you get oriented.

📅 Ready to Make a Plan?

Let’s build your relocation strategy together. I’ve helped dozens of families move to Omaha with confidence—and I’d love to help you too.

Recent Posts