Smart Omaha Buyers Are Saving Thousands on Their Mortgages—Here’s How You Can Too

Shopping Around Could Save Omaha Buyers Up to $44K

When you’re buying a home in Omaha, one of the smartest moves you can make is shopping around for a lender.

Many buyers assume rates are the same everywhere—but they’re not. A recent Realtor.com® analysis of nearly two million loans found that borrowers who compared multiple lenders saved an average of $44,000 over the life of a 30-year mortgage.

That’s not a small number. For a typical Omaha homebuyer purchasing around $425,000 (close to the metro’s mid-to-upper price range for newer construction or suburban areas like Gretna, Bennington, or Papillion), that kind of savings could cover years of property taxes—or even a full kitchen remodel.

If you want to buy a home in Omaha without going over budget, here’s where those savings are hiding.

Your Choices Matter More Than the Market

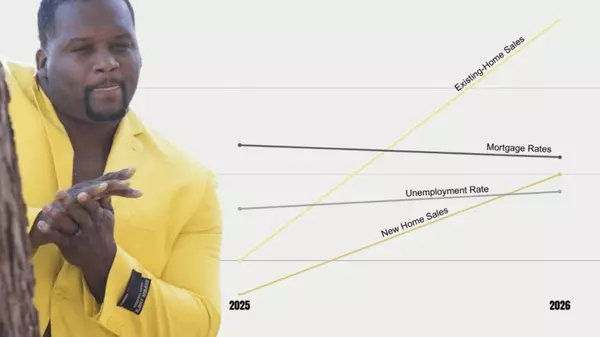

Mortgage rates rise and fall with the economy, but your personal rate depends on your financial picture.

When average rates hover around 6.6%, borrowers with stronger credit, steady income, and manageable debt can often lock rates closer to 6.25%—while others may end up near 7%.

That half-point difference adds up fast. On a $425,000 home, that’s more than $60,000 in savings over 30 years.

You can’t control national rate changes, but you can control how lenders see you.

The Biggest Savings Come from Comparing Lenders

In Realtor.com’s study, rates varied by as much as 0.55 percentage points between lenders.

For a buyer in Omaha purchasing a $425,000 home with 20% down, that difference translates to:

-

💰 About $122 less per month

-

💰 Roughly $1,464 per year

-

💰 Nearly $44,000 over 30 years

That’s a life-changing difference just for taking the time to compare offers.

Pro tip: Contact at least three lenders on the same day and ask for written rate quotes. Compare not just the rate, but also fees, points, and total costs.

If you already have a favorite lender, use competing quotes to negotiate. Most lenders would rather lower their rate slightly than lose your business.

If you need a starting point, I can share a short list of vetted Omaha-area lenders who consistently deliver strong rates and service.

Credit and Down Payment Milestones That Pay Off

You don’t need perfect credit to buy a home, but a small improvement can go a long way.

Moving from “good” (660–720) to “very good” (720–760) credit could drop your rate by around 0.11%, saving about $24 per month—or more than $8,000 over the loan term.

Down payments matter too. Going from 10% down to 20% saves you on PMI and interest. For a $425,000 home, that’s roughly $281 less per month and more than $100,000 saved long-term.

If 20% down feels out of reach, don’t panic—Nebraska and Iowa have great first-time buyer programs that help with down payments and closing costs, including:

-

NIFA (Nebraska Investment Finance Authority): Grants and low-rate loans for first-time buyers statewide.

-

Iowa Finance Authority (IFA): Offers similar programs for buyers looking in Council Bluffs and surrounding areas.

-

VA, FHA, and USDA loans: Flexible programs for qualified buyers with minimal down payment requirements.

Property Type and Use Can Affect Your Rate

The type of property you buy in Omaha also affects your loan.

Investment or vacation homes (like a lake house near Carter Lake or Beaver Lake) typically carry higher rates than primary residences.

Condos and manufactured homes sometimes have slightly higher rates or stricter loan terms, while single-family homes in established neighborhoods like Millard, Bellevue, or Elkhorn often qualify for the best pricing.

More Smart Ways to Save After You Buy

Once you’ve locked in your mortgage, the savings don’t have to stop.

Try these small but powerful moves:

-

🏠 Shop your insurance yearly. Omaha home insurance costs vary widely—get at least three quotes.

-

🚗 Bundle your policies. Home + auto can save 10–20%.

-

💡 Upgrade for energy efficiency. New windows or insulation can cut energy bills by up to 30%.

-

🧾 Check your property tax assessment. Douglas and Sarpy County assessments can fluctuate—appeal if your value seems inflated.

-

💳 Set up auto-pay. Some lenders knock off a small discount or waive a fee for automatic payments.

Final Tip: Work with an Agent Who Knows How to Negotiate

A great buyer’s agent can save you thousands long before closing.

Here’s what that looks like in Omaha:

-

Spotting undervalued homes in markets like Keystone, Morton Meadows, or Benson before they blow up.

-

Reading the market to help you time your offer (for example, homes sitting longer than 20 days may be ripe for negotiation).

-

Structuring offers with inspection credits or rate buydowns that save you money upfront.

-

Protecting your deal with clear appraisal and financing contingencies.

Having a local negotiator on your side means you don’t just find a house—you find the right deal.

The Bottom Line for Buying in Omaha

Buying a home isn’t just about what you spend—it’s about what you save by being intentional.

Start by comparing lenders, improving your credit, and planning your down payment. Then layer in local programs and smart cost-saving strategies.

The more proactive you are now, the more affordable your home will feel later.

In Omaha’s market, where every dollar counts, those savings could be what turns a good purchase into a great one.

Recent Posts